Investments and retirement planning can be as easy as ABC when you have someone you can talk to and guide you through the process.

Taylor Investments at Taylor Credit Union is a partnership with FMS Financial Services and Taylor Credit Union. Financial Professionals Ryan Powers and Kurt Powers are committed to assisting you through any of your investment related needs and questions.

Investment Options:

- Mutual Funds

- Annuities

- Stocks & Bonds

- IRAs

- Qualified Retirement Plans (401K, Simple IRA, 403b, etc.)

- Life Insurance

- 529 Plans

Get help with several investment services, including:

- Retirement Planning – design a custom investment strategy that meets your current and future goals

- Qualified Plan Rollovers – Rollover your qualified plans with specialized assistance

- Retirement Income Planning – Plan for your retirement income needs after the paychecks stop

- Estate Planning – Develop a wealth plan that can be passed on for generations

- Investment Portfolio Analysis – Stay up-to-date with your investment performance and when to make changes, if needed

- Education Planning – Save up for your children’s or grandchildren’s higher education plans

- Life Insurance Planning – Select the type of life insurance that best fit your needs and situation

- Comprehensive Review –Take a complete look at your financial needs and goals

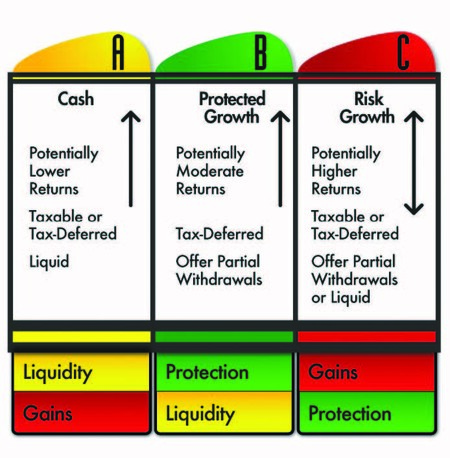

Learn about our ABC’s of the money planning process:

Disclosure: Securities offered through Packerland Brokerage Services, Inc., an unaffiliated entity.

Member FINRA & SIPC.

Regulated by FINRA

This communication is intended for individuals residing in the state of Wisconsin.

The contents of this website do not constitute a solicitation to purchase or sell securities in other states.

No offers may be made or accepted from any resident outside the specific states referenced.

Non-bank / credit union products and securities are not insured by the FDIC/NCUA or any other federal government agency, and are not a deposit of, obligation of, or guaranteed by TaylorCredit Union or Taylor Investments located at TaylorCredit Union.

Investments are subject to investment risk, including possible loss of principal amount invested.

For any of your investment or retirement planning questions or to schedule an appointment,

please call 715-748-2447 or contact either Sean, Ryan, or Kurt directly.